Financial Services

-

With limited historical market data, our probabilistic forecasting enables financial institutions to optimize asset allocation strategies.

By leveraging Time Series Data, our approach considers various scenarios and potential market shifts, allowing for better risk management and enhanced returns.

Probabilistic insights guide investment decisions, allowing financial professionals to make informed choices even in uncertain market conditions.

-

Financial Services can leverage our methodology to forecast credit risk for individual clients or loan portfolios, even with minimal historical data available.

Probabilistic math provides a nuanced understanding of potential credit defaults, allowing institutions to develop more accurate risk models and tailored lending terms.

This approach enhances decision-making by factoring in uncertainties and potential outcomes, leading to more secure lending practices.

-

Understanding customer behavior is crucial. Our approach empowers institutions to predict customer trends and preferences, even with limited data points.

Financial businesses can tailor their offerings, marketing strategies, and engagement by analyzing Time Series Data, enhancing customer satisfaction and loyalty.

Probabilistic insights allow for adaptable strategies, ensuring proactive responses to changing customer dynamics and market trends.

Use Case

Financial Services

Next-Day Forecasting Exchange Data

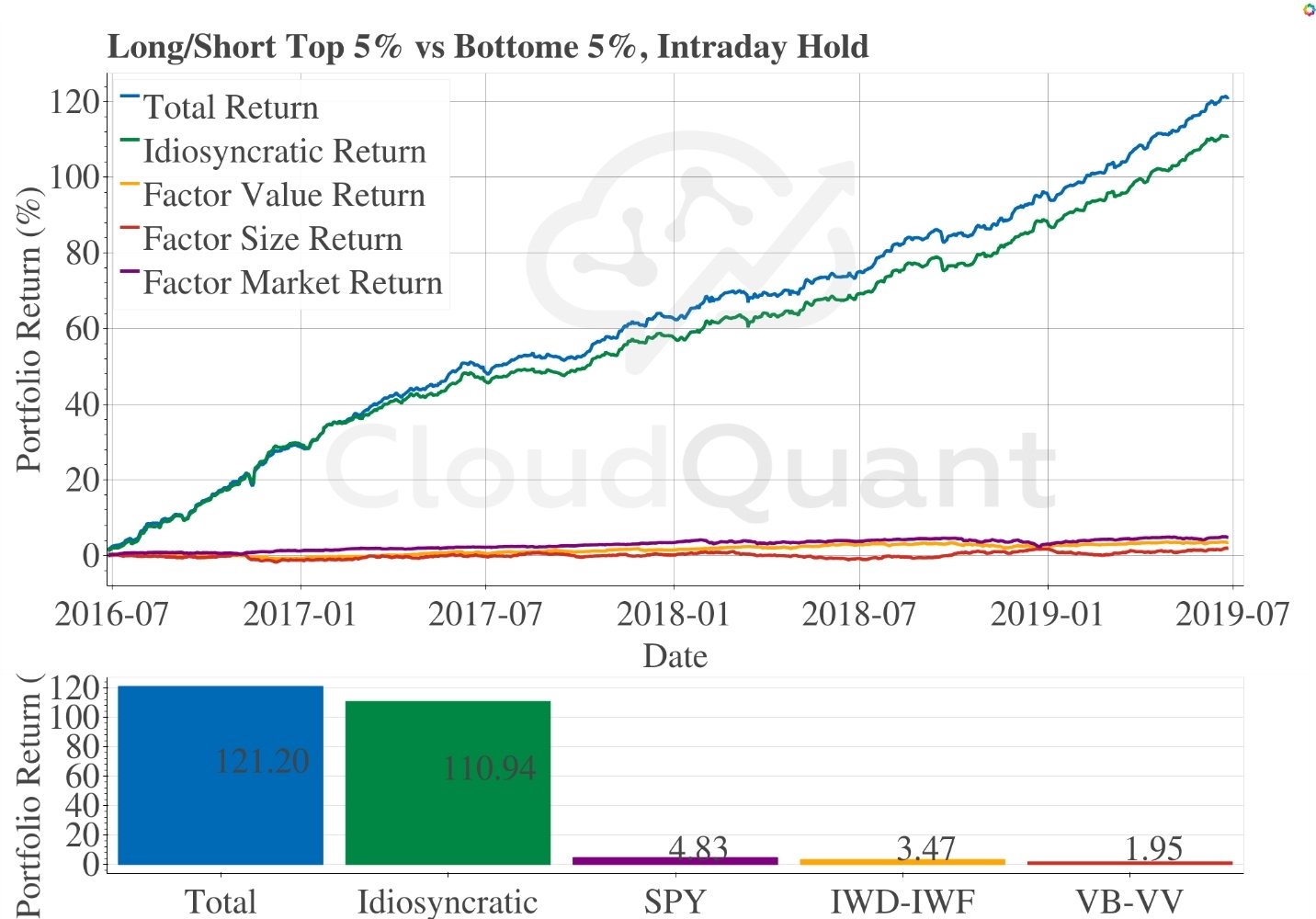

A Long-Short portfolio outperforms $RSP by 37.9%/year using Precision Insight.

“Backtesting on CloudQuant’s Mariner™ showed that a long top 5%-short bottom 5% quantile intraday strategy achieved an overall Sharpe Ratio of 5.36 and a very low CAPM beta.”

- Morgan Slade QloudQuant

-

Financial markets are constantly changing.

Asset management professionals need accurate and unbiased insights to make informed investment decisions.

Predictive models lack precision and are fraught with biases.

-

Precision Insight provides a robust platform that derives exact scientific measurements from market data.

The platform provides the next-day probability of bullish or bearish market movements across 85+ exchanges globally.

Utilizing real-time learning and processing capabilities, Precision Insight eliminates model bias, ensuring precise forecasting regardless of market dynamics.

-

Unbiased Insights: Precision Insight revolutionizes financial decision-making with scientifically exact measurements and unbiased insights powered by real-time learning capabilities.

Improved Returns: Precision Insight streamlines data-driven decision-making and improves risk-adjusted returns.

Reduced Risk: Leveraging independent research, Precision Insight investment strategies have a Sharpe Ratio of 1.9 to 5.36 from various strategies.